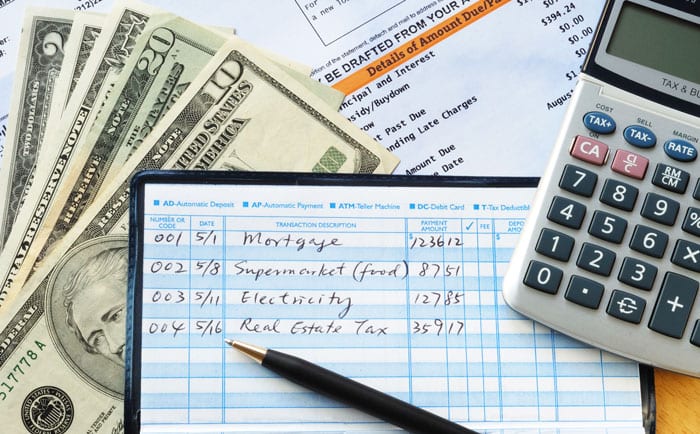

A finance calculator is a tool used to perform various financial calculations accurately and quickly. It is designed to make complex calculations easy and accessible for individuals and professionals in the finance industry.

Finance calculators are widely used for tasks such as calculating loan payments, interest rates, investment returns, and budgeting. They are convenient and time-saving, allowing users to input their financial data and instantly receive accurate results. These calculators come in various types, including mortgage calculators, loan calculators, investment calculators, and retirement calculators.

They can be found online or as mobile applications, making them easily accessible to anyone with internet access. By utilizing a finance calculator, individuals and professionals can make informed financial decisions, plan for the future, and gain a better understanding of their overall financial health. Whether you are a student, a business owner, or an investor, a finance calculator is an essential tool that can greatly simplify and enhance your financial planning and analysis.

Credit: www.incharge.org

Understanding The Importance Of A Finance Calculator

A finance calculator is a valuable tool for individuals and businesses alike. It helps in performing accurate and efficient calculations related to financial matters. By utilizing a finance calculator, you can quickly determine things like interest rates, loan repayments, investment returns, and other important financial figures.

This tool can greatly benefit you by saving time and effort, as well as minimizing the risk of errors in complex calculations. Furthermore, a finance calculator empowers you to make informed financial decisions and plan for future goals. Whether you are a student, a professional, or an entrepreneur, understanding and utilizing the power of financial calculations is essential in achieving success.

So, make sure to leverage the benefits of a finance calculator to streamline your financial planning and stay on track towards your financial objectives.

Mastering The Basics Of Financial Calculations

Mastering the basics of financial calculations is crucial for anyone looking to manage their finances effectively. One key area to focus on is unlocking the potential of compound interest calculations. By understanding how compound interest works, you can make informed decisions when it comes to saving and investing.

Another important aspect is calculating loan repayments with ease. A finance calculator can help you determine the amount you need to pay each month, ensuring that you stay on top of your financial obligations. Additionally, budgeting calculations are essential in determining the optimal budget for your needs.

By analyzing your income and expenses, you can identify areas where you can save money and allocate funds accordingly. With the right tools and knowledge, you can confidently navigate the world of financial calculations and achieve your financial goals.

Advanced Financial Calculations For Long-Term Success

Finance calculator provides advanced tools for long-term financial calculations, such as retirement planning and analyzing investment opportunities. These calculators help individuals optimize their savings and work towards financial independence. With a user-friendly interface, they enable users to input various financial data and make informed decisions.

From estimating future retirement income to determining the potential returns on investments, these tools offer valuable insights into long-term financial success. By utilizing finance calculators, individuals can take control of their financial futures, make educated choices, and achieve their monetary goals.

So, whether it’s planning for retirem必利勁 ent or optimizing savings, finance calculators prove to be invaluable instruments for long-term financial planning. Start maximizing your financial potential today!

Conclusion

Overall, the finance calculator is a powerful tool that can greatly simplify your financial planning journey. By utilizing its various functions, you can accurately calculate loan payments, interest rates, and savings goals with ease. Its user-friendly interface makes it accessible to everyone, regardless of their level of financial knowledge.

Whether you’re a student planning for college expenses, a business owner looking to assess profitability, or simply someone who wants to budget better, the finance calculator has got you covered. By taking advantage of this tool, you can better understand your financial situation and make informed decisions.

So why wait? Start optimizing your financial success today with the help of the finance calculator.